Direct Subsidized Loans vs. Direct Unsubsidized Loans

Direct subsidized loans are loans made to eligible undergraduate students who demonstrate a financial need to help cover the costs of higher education at a college or career school. Because they are designed to help students with a financial need, subsidized loans have slightly better terms and conditions. Interest is subsidized by the government while you are enrolled at least half-time.

Direct unsubsidized loans are loans made to eligible undergraduate, graduate, and professional students, but in this case the student does not have to demonstrate a financial need to be eligible for the loan. Interest accrues while you are enrolled in school.

NOTE: *PLUS, or parent loans are also unsubsidized. PLUS loans do not impact your first time loan borrower status.

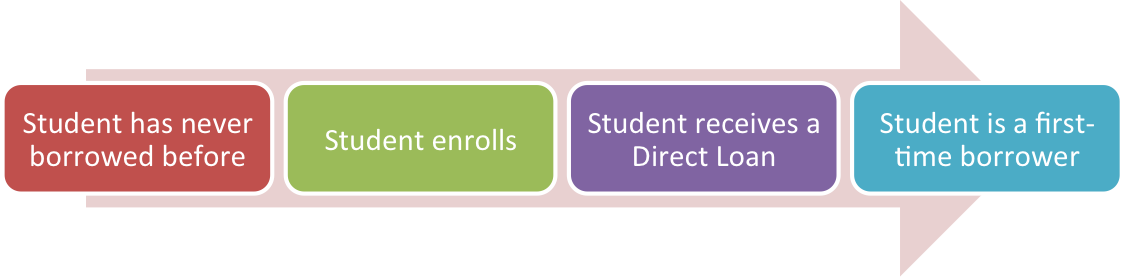

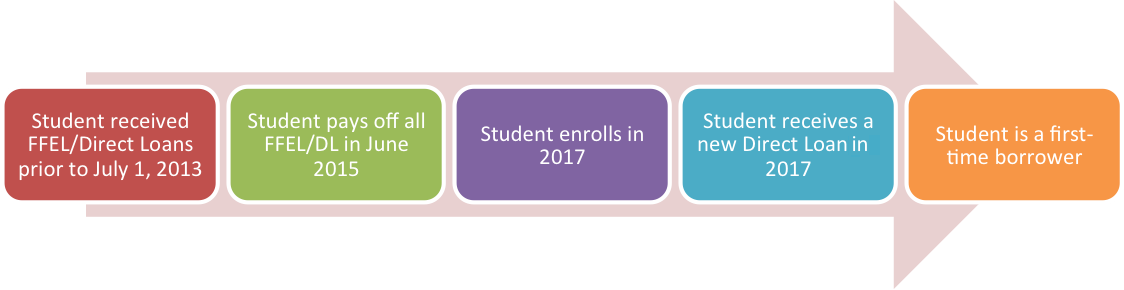

Are you a first time borrower?

“First-Time Borrower”: An individual who has NO outstanding balance of principal or interest from a student loan at the time they apply for a new student loan.

“First-Time Borrowers” who take out a Federal Direct Subsidized loan on or after July 1, 2013 are eligible to receive subsidized loans for up to 150% of the published program length in which they are enrolled.

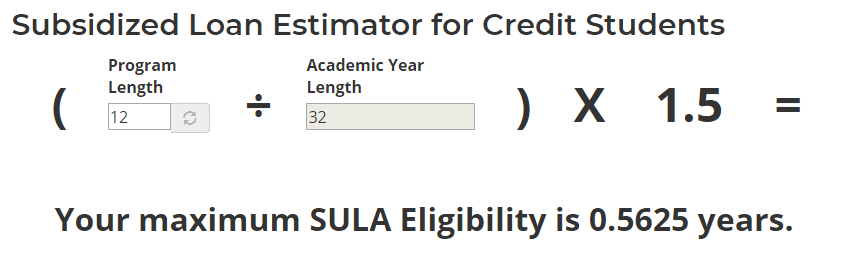

Maximum Eligibility Calculation for Subsidized Loans

Maximum Eligibility Period (MEP) is the time period equal to 150% of the published length of the academic program in which you are enrolled.

If you are enrolled in multiple programs, the Maximum Eligibility Period is based on the length of the longest program you are enrolled in. If you withdraw from the longest program, the Maximum Eligibility Period will decrease to the next longest program in which you are enrolled.

*If you are enrolled at different schools you are eligible to hold separate loans at each institution

Subsidized Usage Period

- Your subsidized usage period is the sum of the period(s) of time which you have received a Direct subsidized loan(s).

- The subsidized usage periods are rounded up or down to the nearest tenth (0.1) of a year.

- Your subsidized usage period is based on the data reported by your institution which is determined by the program you declared in the student information system. You should verify that you declared the correct program in the student information system.

- Your total subsidized usage period is compared to your Maximum Eligibility Period to determine if you are eligible for additional Direct Subsidized loan

Loss of Eligibility

- If you fail to maintain satisfactory academic progress (SAP) you may lose all of your financial aid eligibility, regardless of whether or not you have remaining direct subsidized loan eligibility.

- If you have a remaining eligibility period of zero or less, even if you have not exceeded the subsidized aggregate loan limit.

- If you have reached the subsidized aggregate loan limit, even if there is time remaining in your remaining eligibility period.

- If you take a break in the program enrollment data or fall to “less than half time” in your enrollment.

- If you are reported as withdrawn you may lose subsidy on all loans effective on the date of your withdrawal.

Appealing

You cannot appeal or challenge the application of the 150% limit in order to remain eligible for direct subsidized loans or have the interest subsidy reinstated.

If there is a reporting error that results in your loss of eligibility for a direct subsidized loans or loan’s subsidy, the Department of Education will work to correct the error. Remember this does NOT guarantee reinstatement of the direct subsidized loan. It is your responsibility to ensure that you report the correct program information in the student information system.

Additional Information

You may return the disbursed loan to your institution and request to have the school return the funds within 120 days of disbursement in order to preserve your direct subsidized loan eligibility.

If you are ineligible for a direct subsidized loan or if you are close to the end of you Maximum Eligibility Period you can apply and receive an unsubsidized loan to cover the remaining costs. All applications are done through the Free Application for Federal Student Aid (FAFSA) process.

If you need further information please visit: